|

Help

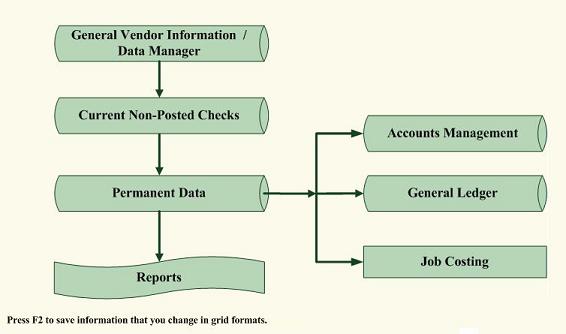

ACCOUNTS PAYABLE is divided in to

four main parts.

The first part of ACCOUNTS PAYABLE

is BASIC CHECKING that is designed to look and feel like

your check book except that all of the more complicated

fields are there that are not on your check book suck as

account number, category number / category description and

the XX field - X to pay now, * for a condensed check and a

space to pay later.

The second part of the accounts

payable is the Enter Check Information menu.

This menu

option allows the user to search for the vendor by

name. If the

user chooses the check information option the program will

then prompt the user for more detailed information on the

received amount such as check number, amount paid, amount

invoice, job name, vendor number.

The program then stores this information for later

use. The second part of the accounts payable program is

the check register which has its own help section.

Both Basic Checking and Enter Check

Information can be used interchangeably.

For both Basic Checking and Enter Check

Information, Amount Due line item figures represent only

the Amount Due for the line item (Invoice Amount - Amount

Paid) not for the entire invoice.

Amount due in the subtotals and totals in the

reports represent the Amount Due on the invoices /

filtered by invoice number as it should be.

The third part of accounts payable

is the report menu which generates a number of reports

including statements for income at any point in time,

monthly, yearly reports and 1099's.

Accounts payable gives you the

option to pay checks later and write them ahead of time.

The field XX as displayed in the check entry parts

of the program needs to have a X in it before the checks

can be routed to the screen or printer and the stored to

permanent data.

This will probably confuse some people if they do

not see this variable, but we received many requests for

the ability to write checks and only pay some of them at a

time. The

symbol * denotes condensed checks for the purpose of

writing the same vendor one check for several different

jobs.

The DATA MANAGER is

also in this module, as in the other modules in order to

effectively manage general (in this case vendor)

information.

.7.

CHECK REGISTERS

There are check register programs

located in both ACCOUNTS PAYABLE AND PAYROLL.

We decided set computerized check formatting up so

that there would be 2 check stubs and 2 checks per page.

Laser printers do not like to have partially

processed pages sitting in them therefore, the additional

decision was made to have pages eject after checks are

printed. This

means if you have an odd number of checks in a batch you

will either waste one of the checks or have to send it

through the printer again if you do not want to waste it.

If you have a dot matrix printer you can simple

roll the check page back after printing to avoid wasting a

check. We

tested this program with Check Soft Express from Office

Max.

The first option in the check

register menus are CHECKS TO SCREEN.

In this option, checks and pay stub information are

sent to the screen as if printing.

In the second option, CHECKS TO PRINTER, checks are

sent to the printer in the form of checks. ( if the checks

are marked with a X or a * in the XX field).

Condensed check are written by

writing several checks to the same vendor with the XX

field marked with a *.

** For release 5 of this program,

please restrict yourself to one condensed check at a time.

The program currently cannot produce more than one

condensed check per check run.

If you mark the PAYTYPE field as

CASH or CREDIT then the program will not produce a check

when this information posts and the checks are run.

**

If the check information is correct

one should "POST CHECKS THE PERMANENT CHECK REGISTER"

which will store all printer checks in the CHECK REGISTER

to the PERMANENT CHECK REGISTER and will print.

The CHECKS TO SCREEN option can

"STORE CHECKS TO THE PERMANENT CHECK REGISTER", but the

assumption is that you will probably not use this because

printing checks is easier that writing them by hand.

For both Accounts Payable and

Payroll the DATEPAID field is automatically filled in for

you when the checks are printed and then you are asked "

ARE THE CHECKS RIGHT AND READY TO BE STORED TO THE

PERMANENT CHECK REGISTER ?" and you say "YES"

The Adjust Accounts Information is

very much like what your bank might show you and is

described as followed:

.8.

When you write checks the check

amounts are deducted from your balance that you currently

see from the Accounts Management Screen.

If the top of this screen says "CHECKING ACCOUNT"

then Accounts Payable and Payroll checks you write will

deduct from the "CHECKING ACCOUNT" when you post the

checks to PERMANENT DATA. If the top of this screen says

"SAVINGS" then the checks you write in Accounts Payable

and Payroll

will deduct

from the "SAVINGS" account when you

post the checks to Permanent Data.

ECT... You have 4 accounts you can set up under the

CHANGE ACCOUNTS INFORMATION option. If you go to CHANGE

ACCOUNT INFORMATION and then USEACCOUNT you may enter a

number from 1 -4 which will decide which of the 4 accounts

the program points to. The DEPOSIT / WITHDRAWAL REPORT

also exists in the Accounts Payable report menu and shows

detailed information on your account activity just like

your bank might show it to you.

CHECK REGISTER REPORT is a report

with amount totals for this check batch.

ALIGNMENT REPORT makes sure the

checks and printer is aligned correctly.

Database Grid are options that view

the various databases in which information is stored.

AR does

auto (on the fly) calculations inside grids.

At this time AP only does auto calculations, only

when writing checks or posting. If you choose to mark

records in AP as paid that are not paid or unpaid that are

paid then the reports will reflect these inaccuracies.

.9.

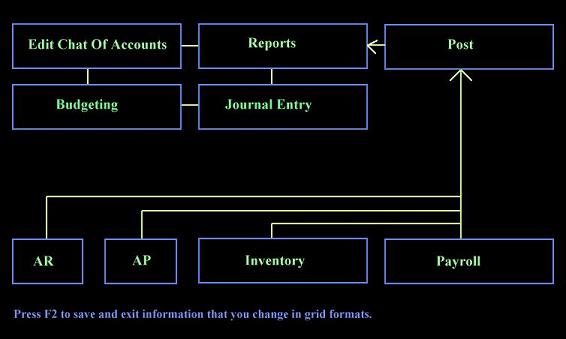

General Ledger

Balance Sheets

Capital Statements

Chart of Accounts

Income Statements

Profit Loss Statements

Trial Balances

Budgeting

Journal Entry

General Ledger / Job Costing Interface.

Total

Fixed Inventory is automatically reflected in General

Ledger as account number 12002.

The general ledger part of the

program keeps tract of general ledger account information.

General ledger account numbers and corresponding

descriptions are linked to the various parts of the

accounting program by keeping track of what kind of

transaction is taking place and for what amount.

Standard reports that appear in this part of the

program include balance sheet, capital statement, chart of

accounts, income statement, profit-loss statement, trial

balance and journal report.

The post option in general ledger

posts all current information from various parts of the

program to general ledger.

Applications for this type of information includes,

tracking where the largest amounts of transactions are

taking place, profit margin analysis and quick access to

total figures on account information and forecasting.

The POST AMOUNTS TO GENERAL LEDGER option takes all

of the check information entered in accounts receivable,

accounts payable, inventory, job costing and payroll and

matches account numbers with general ledger account

numbers. It

then sums this information in to the appropriate debit and

credit column for each account number.

When we were testing the Post

option we thought something was wrong because all of the

values that we expected to fill in were not filling in.

The computer code reads -

USE ARPER

SET FILTER TO SUBSTR(ACCOUNTNO,1,5)

= ACN .AND. DATEPAID > BD .AND. DATEPAID < ED

SUM AMOUNTREC TO ACCTOTAL

Which means I need date paid values

filled and account number values filled in for this to

work and for Accounts Payable and Payroll I need to post

check information to the Permanent databases (so that the

DATEPAID values fill in).

While testing this I forgot to fill in the DATEPAID

field for some of the values I was expecting to post to

General Ledger.

My mistake.

For both Accounts Payable and

Payroll the DATEPAID field is automatically filled in for

you when the checks are printed and then you are asked "

ARE THE CHECKS RIGHT AND READY TO BE STORED TO THE

PERMANENT CHECK REGISTER?" and you say "YES", which means

that checks need to be posted to permanent data before

General Ledger will reflect this information. Why should

checks that have not been printed or distributed be

reflected in General Ledger?

They should not.

.10.

Journal Entry allows the user to

make debit and credit alterations that act on the various

account numbers and account descriptions.

When you use the post option in general ledger all

of the journal entries will be erased and the current

state of the accounting package information will be

presented again for the time period entered.

EDIT CHART OF ACCOUNTS allows for

the input of new charts of accounts or the altering of the

existing chart of accounts.

The stipulation on this is that you use 5 digit

account numbers in the EDIT CHART OF ACCOUNTS option and

in the rest of the program.

Aplus Accounting uses a single

posting method for General Ledger and not a double posting

method for General Ledger.

This means that if you want your trial balance to

balance, instead of expecting the program to add false

offset figures to the postings which forces the trial

balance to balance it is up to you to balance your trial

balance. This

can be done with doing your own double posting in the Edit

Chart of Accounts grid or doing your own double posting in

Journal Entry inside the General Ledger module.

We prefer reality over fiction.

If your accounting package is doing an automatic

double posting method we do not think that this is a

realistic view of the current state of your company.

Budgeting is similar to Edit Chart

of Accounts and Trial Balance but instead of reflecting

the actual state of your business Budgeting reflects your

desired state of your business.

As with most parts of the program, users may edit

the account numbers, descriptions and totals in budgeting

as much as they like.

.11.

Inventory

Inventory Control

Inventory control has multiple interfaces

for managing and searching for your inventory data.

Report Menus

Fixed Inventory

Fixed Inventory also has multiple

interfaces for managing and searching for your inventory

data.

Report Menus

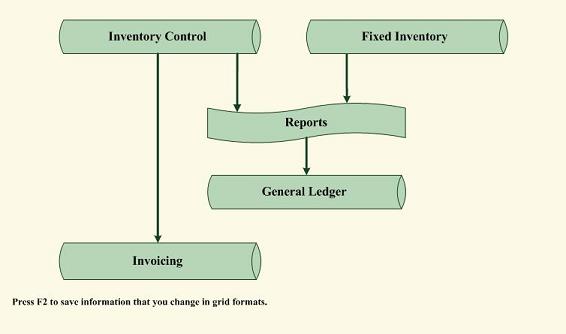

This program has 2 inventory

modules. The

first one is activated when INVENTORY is pressed in the

main menu the user will see the INVENTORY CONTROL MENU.

This program is designed to find items subtracted

from its quantity variable when products and quantities

entered in INVOICING match the model variables in

INVENTORY. In

this way the user can keep track or quantities in

inventory just by considering inventory to be reduced at

the time of invoicing.

The FIXED INVENTORY MENU is the same program except

it works off of a completely different data set and

inventory is not reduced from it at the time of invoicing.

Normally fixed inventory is inventory that companies do

not sell on a regular basis such as their office

furniture.

I have given users the opportunity

to user either quantities in inventory or serial numbers.

If you are using quantities in your data records

then it would be inappropriate to use serial numbers also,

because then one data record would only pertain to one

item in inventory, but we felt that this flexibility to do

things either way should be there.

These inventory modules keeps track

of inventory by sorting, adding, deleting and editing

inventory items in a number of ways.

The view option allows the user to

choose from stock items or model number to isolate the

item that is searched for.

In addition, the view option is the largest part of

the inventory program and can even directly edit inventory

items after they have been isolated as well as sorting

data. The

change option allows for the quick changing of inventory

levels as do the data manager screens.

The delete option deletes stock items. The add

option adds stock items.

VIEW INVENTORY and CHANGE INVENTORY

LEVELS were originally written as a DOS application

because we liked the look and feel of many of the

inventory programs that we were seeing.

In our opinion, windows programs often still lack

in leading the users through every step of what the user

should be doing, thereby making the programs dummy proof.

For this reason we left some dBase for DOS code in

this large windows accounting program.

If you do not like VIEW INVENTORY and CHANGE

INVENTORY LEVELS, the same tasks may be accomplished

through the windows looking part of the inventory program

(Data Manager, Grid and inventory reports).

.12.

Inventory Control and Fixed

inventory are identical except that in Inventory Control,

inventory is subtracted from its quantity variable when

products and quantities entered in INVOICING match the

model variables in INVENTORY.

The report menus are present in

both the INVENTORY CONTROL program and in the FIXED

INVENTORY program and reports act respectively on the two

different data sets.

The inventory module can be used

with bar code scanning in to inventory.

Future versions of this program

will include automatic reports to the user on items that

need to be reordered and automatic reordering to vendors

via fax, Email or modem.

.13.

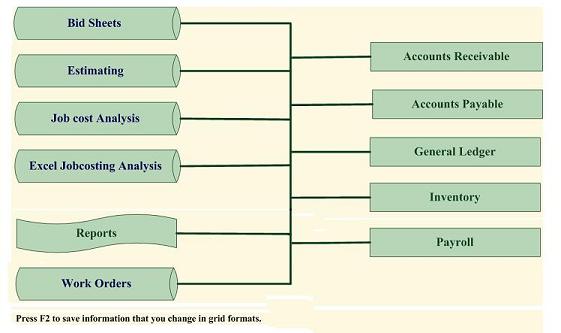

Job Costing

Bid Sheets

Post Estimates to Bid Sheets

Estimating

Job Cost Analysis

Change Orders

Report Menu

Work Orders

Time and materials management as with all

of job costing.

Excel Job Costing Interface

Database View And Search Menu

When creating a new job in JOBCOST

ANALYSIS or ESTIMATING job number needs to be 3 digits and

relates to the specific job that you are creating.

The number will be generated automatically when

adding jobs.

In the rest of the program the job number is the last 3

digits of the account number. EX.

In order for 002 in Job costing to pull in

information from the rest of the program the Account

numbers in the rest of the program need to be numbers like

EX. 23000.002

The JOBCOSTING part of this program

is divided in to 10 main parts(BID SHEETS, ESTIMATING,

JOBCOST ANALYSIS, EDIT GENERAL DATA, UPDATE JOBCOST

ANALYSIS, CHANGE ORDERS, REPORTS, WORK ORDERS, EXCEL

INTERFACE and DATABASE VIEW MENU )

The first part of Job Costing is

Data Manager.

As with the other modules this option is for general /

basic information on the different jobs.

The second part of Job Costing is

BID SHEETS.

This option allows for the automatic production of bid

sheets by posting ESTIMATE information in to BID SHEETS

after changing the different amount percentages to account

for profit to the job being bid for.

The third part of JOBCOST is

Estimating / Budgeting.

The words estimating and budgeting are synonymous.

ESTIMATING/BUDGETING is not linked to anything because it

is usually used before any activity has begun on jobs.

In the fourth part of job costing

is job cost analysis and this part of the program is

available on request only.

This is the most comprehensive part of Aplus

Accounting

and calculates what is received and

paid on the different jobs.

.14.

The fifth part of JOBCOSTING is

CHANGE ORDERS.

Cost over runs frequently occur on jobs and require an

additional contract between the contractor and contracted

for the purpose of acknowledging the additional cost over

runs on the job.

This options does not interface with anything else,

but when the contracted is invoice and pays on the

additional work then the effect of the change order will

be seen.

The additional assumption is that

the because change orders are a cost overrun, the

universal construction code is already entered in BID

SHEETS, ESTIMATING and JOB COST ANALYSIS.

The CHANGE ORDERS is one of the

many parts of the program that automatically generate a

number, in this case the CHANGE ORDER NUMBER.

The sixth part of

JOBCOSTING is JOBCOST REPORTS.

The job cost reports link to accounts receivable,

accounts payable and payroll.

By being able to access all of this information in

single reports the program determines all profit and loss

information applicable to the different jobs as the job is

in progress.

The seventh part of JOBCOSTING is

WORK ORDERS.

Work orders are for assigning work to employees in an

extremely structured manner.

Job Costing as usual there are 2

sets of address.

There are 6 date fields in WORK ORDERS determine

different parts of the work progress, as well as the usual

universal construction codes and descriptions to tie in to

each work assignment.

.15.

Work orders has its own help

section off of the ? icon as is repeated in the next

paragraph:

Work orders is a part of Job

Costing that keeps detailed information on work in

progress. By

comparison Bid sheets do a good job of bidding for jobs,

Estimating does a good job of figuring expenses on jobs,

Job Cost analysis and Job Cost Reports do a good job of

keeping track of what is currently being spent and made on

different jobs.

There is a fairly comprehensive

REPORT MENU off of the main WORK ORDER SCREEN.

Work Orders are divided in to

incomplete work orders and completed work orders.

Only work orders that are marked

as completed will post to the Stored / Completed /

permanent work order database.

Likewise the work order reports are divided in to

incomplete and completed.

In addition Post Completed Work Orders To Invoicing

posts from the stored work order table to invoicing

without deleting any work orders in the work order module.

Future versions of this program will post to

payroll.

The reports work off of Date Due.

If you do not fill in Date Due then the reports

will not show.

The ninth part of Job Costing is

Excel Job costing Interface.

This options is designed to export the Aplus

Accounting database files to EXCEL .XLS files.

In doing so it overwrites all information in

previous .XLS files.

The tenth part of JOBCOSTING is DATABASE VIEW MENU

which allows the user to view the different Aplus

Accounting database files in grid format, much in the

same way you would if you used the EXCEL JOBCOSTING

INTERFACE.

.16.

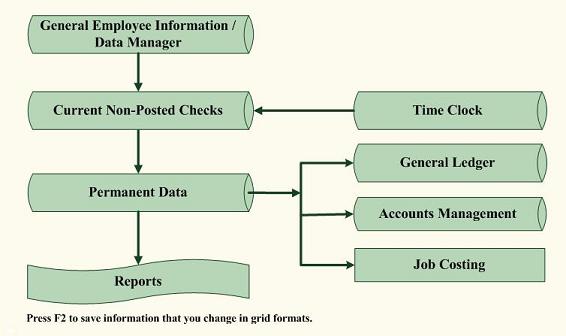

Payroll

Basic Payroll

Comprehensive Payroll

Check Register

Accounts Management

Check printing and batch processing.

Time Clock

Post time clock information to payroll

checks.

Report Menus

W2s

Usernames are up to 25 characters

and passwords are 20 characters.

As with most of this program the

payroll module is extremely comprehensive as can be scene

with the equations for GROSS and NET.

GROSS = (RATE *HOURS) +

((RATE*1.5)*OVERTMHRS) + BONUS +VACATION

+OTHEARN-GARNISH-HEALTHINS-LIFEINS-PENSION-ADVANCES-DENTAL-WORKMENSCM-UNIONDUES-LOAN-OTHDEDUCT

NET = (GROSS - TAXES + BENEFITAMT)

TOTDEDUCTIONS=

(ADVANCES+DENTAL+GARNISH+HEALTHINS+LIFEINS+LOAN+

OTHDEDUCT+PENSION+UNIONDUES+WORKMENSCM)

As with the most of the program you

must first enter general information (employee name,

employee number, deductions and state withholding percent)

before you can write them checks.

If something does not look like it

calculated correctly chances are that it did calculate

correctly and you are not seeing all of the fields in use

on the screen you are on.

The payroll program is divided in

to seven main parts.

The first part of the payroll

program is BASIC PAYROLL.

This works much in the same way as BASIC CHECKING

in ACCOUNTS PAYABLE but has all of the many payroll fields

that you should have available to you in any payroll

program.

The second part of the payroll

program is COMPREHENSIVE PAYROLL.

This works much in the same way as BASIC PAYROLL.

All of the fields that you should have available to you in

any payroll program are here as in BASIC PAYROLL expect

all most everything is in a grid format instead of in a

screen format.

If you want something to save then get off of the last

field / column you enter something in before exiting and

if anything is not saving correctly then press F2 instead

of escape to exit. You can mark a record for deletion by

clicking on the extremely narrow far left column without a

label above it.

This will turn the small square black and then when

you exit it will be deleted.

.17.

The third part of the payroll

program is PAYROLL - JOBCOSTING.

While Basic payroll and

comprehensive payroll works off of the same data as

PAYROLL - JOBCOSTING they only lets you write one check to

an employee per check run, with PAYROLL - JOBCOSTING you

can only write multiple checks to an employee per check

run.

This menu option allows the user to

search for the employee by employee name.

Once this general information has been located the

computer prompts the user for either check information or

to return to pay roll menu.

If the user chooses the check information option

the program prompts the user for more detailed information

such as check number, amount, job name.

The payroll program then stores

this information for later user after calculating all

taxes and letting the user view the taxes.

The fourth part of payroll is the

payroll check register which is described in the check

register part of this manual on page five.

The fifth part of payroll is the

time clock which can keep track of all employee work time

through them clocking in and out.

As in all the main modules of this program you need

to have the general information such as the employee name

set up at least in part before they will show up on the

time clock.

Time Clock is security intensive

and therefore, does require a that Administrator USERNAME

and PASSWORD be entered in to TOOLS - PASSWORDS if you are

using any other options except CLOCK IN

and CLOCK OUT.

Entering any other option except

CLOCK IN and CLOCK OUT will be evident in the Exception

Report (changed data report). The USERNAME and PASSWORD

information for CLOCK IN and CLOCK OUT comes from the

general payroll information which may be seen in the

PAYROLL - Data Manager.

The USERNAME and PASSWORD information for options

other than CLOCK IN and Clock Out comes from Tools -

Passwords.

The sixth part of the payroll menu

is the report menus. The reports show information in

different forms and with different combinations of

information.

If you don't see the information in the form you wish then

try looking at a different reports (if all the different

variables on each check where put side by side on the same

report the report would be too wide for any printer).

As with the rest of the program many of the payroll

checks are date coded so that you may have reports for any

time period you wish.

The paywords will fill in for you

to 1 cent under $23,000.00.

Past that amount you will have to fill in the

paywords your self - for now.

NOTE : General payroll information such as name, state

w/holding percent, deductions and marital status must

be entered in the general information Grid or the last

part of the payroll module DATA MANAGER before the

federal and state taxes will calculate correctly.

.18.

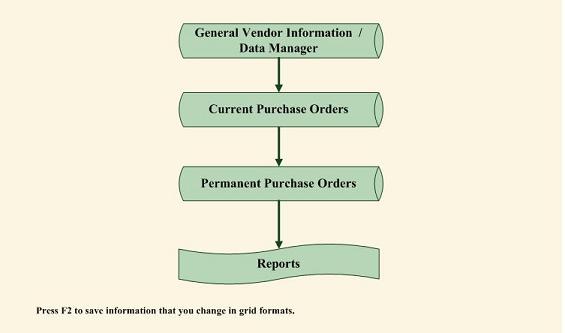

Purchase Orders

Enter Purchase Order Information

Dispute Interface, Shipping Interface

Data Manger

Report Menus

Purchase Orders look similar the

invoicing part of the program and act in exactly the

opposite way from invoicing.

That is, instead of billing a customer will an

invoice for a product you sold them or that you are going

to sell them, you are sending your vendors a form stating

what it is that you are going to buy from them.

Keep in mind, you have not bought anything from

anyone yet, therefore, there are not any amount paid

fields or any credit card interfaces in purchase orders.

Use the main Accounts Payable module to pay companies for

products at the time you owe them the money.

The main fields ( not the more

detailed fields like SHIPPING, TERMS, SHIPVIA ) in

Purchase Ordered are QUANTITY ORDERED, QUANTITY RECEIVED,

PRODUCT, UNIT PRICE and TOTAL.

If you leave the TOTAL field blank and fill in

QUANTITY ORDERED and UNIT PRICE then the program will

automatically fill in TOTAL with ( QUANTITY ORDERED * UNIT

PRICE).

This purchase order program is

divided in to three main parts, PURCHASE ORDERS (which

processes PO's), LOCATE (which retrieves PO's ADDS / EDITS

/ REPRINTS Purchase Orders) and the Purchase order REPORT

MENU.

The PURCHASES ORDER section prompts

the user for variables such as product, quantity, amount

invoiced, amount paid.

It then calculates the amount due and stores this

information for recall in reports or in actual purchase

orders.

The REPORT MENU on this program

accesses all PO information ever entered by accessing

various purchase order reports using information in both

the current and permanent databases.

The remaining options ADD, EDIT,

DELETE vendors have to do with file maintenance and are

designed for more general vendor information management if

needed and act off of the same vendor databases as the

(Add vendor, Delete vendor, Edit and Grid) in the ACCOUNTS

PAYABLE MENU.

As is the similar case with the rest of the program,

vendors need to be ADDED before PO's may be written to

them.

POST RECIEVED Pos TO PERMANENT DATA

will not post anything unless you mark purchase orders as

received with some mark in the received field.

.19.

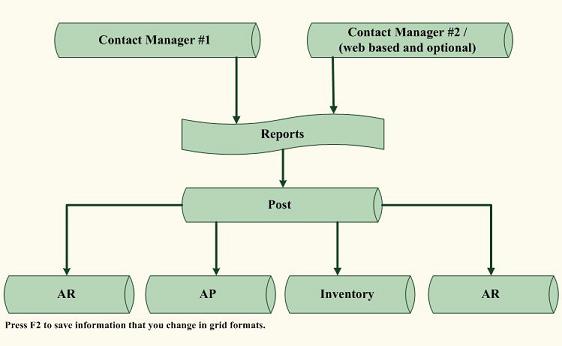

Contact Manager

Contact management allows for the

storage off all names, addresses, phone numbers, email

addresses, website information and miscellaneous

information on anyone who's

information you wish to store and retrieve.

Reports Menus

The report menu section has a

option to post any contact information to Accounts

Receivable, Accounts Payable, Inventory or

Payroll so that if someone becomes

a customer, vendor or employee, you will not have to

re-enter any of their general information.

The most basic type of program in

the world in my opinion is the contact manager.

This type of program / in this case module keeps

tract of general information.

If you are speaking with someone and they are not a

customer and they are not a vendor or employee and you

wish to keep their contact information this is a good

place to put them.

The data for this module was

originally set up for a travel agency and lists a couple

hundred resort hotels around the United States with some

of the pictures running off of the View button (that is on

all general information screens).

If you do not have this resort information and

would like to have it let us know.

When you press ADD in contact

manager the date field automatically enters today’s date

so that the reports off of the REPORT MENU BUTTON can

filter off of different date ranges.

.20.

Tools

Enter current company information and check

formats.

Backup data, restore data and delete data

before a date.

Import data into the accounting program.

Enter zip codes and tax rates.

Login and exception reports.

Area Codes, States and Country lookups and

searches.

The TOOLS program lets the user

manage file information in a variety of different ways and

view computer configuration important to the program's

operation.

The first two options of this menu

enable the user to back up programs data to either drive

E: or drive F:. The second two options of this menu enable

the user to restore programs data from either drive E: or

drive F:.

Delete all data before a date. /

Year End Closing deletes all data in permanent databases

with data earlier than the date you specify.

Beware, do not

delete any data you wish to keep of you will have to

restore it from back up data.

The PASSWORD option of the TOOLS

menu is larger than it looks.

If you do not leave a password in this space then

the program will not prompt anyone for passwords.

If you do leave a password in this space the

password programming will be activated.

You can type in as many usernames and passwords as

you like and require that people using the program

remember their usernames and passwords that are entered

here. If the

program is used in this manner then various parts of the

program like the restaurant module will keep track of who

has been using the program when and will run some reports

on this subject. Usernames are up to 25 characters and

passwords are 20 characters.

CHECK DATA FILES AND DISK SPACE

shows what data files the program is using and how much

hard drive space is available.

This program needs at least 20 megabyte(20,000,000

bytes) for itself to operate correctly.

Your hard drive should have at least 300 MB of free

hard drive space for a healthy hard drive.

CHECK COMPUTERS MEMORY checks random access

memory(RAM) on the computer while this program is running.

Available RAM should be at least 128MB.

Various diagnosis tools such as defrag and

MSSYSINFO can tell you if you are having hardware problems

with your hard drive or RAM.

ENTER ZIP CODES AND TAX RATES is

originally from the US post office and contains many

domestic and foreign zip codes which the

various ZIP buttons in the program

will act on after you type in a zip code.

Right now the accounts receivable data manager is

set up so that if you enter a zip code and then press

enter or hit the zip code button then the city, state,

country, city tax rate and state tax rate will be filled

in for you. We

do not wish to keep track of all of the city and state tax

rates for the country, therefore, if you are doing

business in a certain city and state you may wish to go in

to the ENTER ZIP CODES AND TAX RATES option and make sure

the tax rate information is correct for the areas you are

doing business in.

ENTER CURRENT COMPANY INFORMATION

is a good place to keep your contact information and tax

license numbers so that this information may be

automatically added into some of the reports, such as,

contact information will appear in invoices and purchase

orders to name a couple.

PACK ALL DATABASES, compresses all

of the databases used in the program which makes the data

more efficiently stored and free of any accidentally added

blank records.

The next version of TOOLS will

contain a CONTRACT button of many of the world popular

contracts not included in the rest of the program such as

Copyright, Patent, Incorporation contracts to name a few

of many.

Company Logo options will also be

listed here.

QUIT

Many of the menus have the word

quit written on them.

This does indeed get you out of the program.

.22.

NOTE

ON THE GRID / BROWSE EDITOR

The parts of the program options

which have the word Grid or the word edit in the option

use the Aplus Accounting grid editing feature.

You can move anywhere in the data and any changes

you make may be saves by pressing F2. If you wish to

delete a data record(row) press CTRL/U or click the far

left extremely small unmarked field and make sure you see

it turn black. move off of the row you have marked for

deletion and then press F2 to save changes and deletions.

We believe in letting users enter

information in grid formats should they wish to.

Spread sheets have been extremely popular in the

past probably in part because of this full screen data

editing capability.

Escape on a grid option should not

save anything if you stay on the same record you edited.

If you move off of the record you edited then

Escape or F2 on a Grid option should save your changes.

If you are entering information in

a grid you need to get off of the current field / column

before the information in the field will save.

Hopefully this will be better in the new version of

Aplus Accounting that just came out. ** This is one of the

few cumbersome parts of this language compiler we have

seen. If this

is bothering you, one could use other parts of the program

and not use grid formats to enter and edit information.

Records may be added to grids by

the drop down menu then go to Tools The go to Append New

Record. If you

are adding a record to Invoicing or Purchase orders for a

new Invoice or Purchase order line item then you should

include the new invoice number or purchase number in the

new record.

.23.

Common user mistakes.

General information such as name,

address tax percents need to be added on customers,

vendors and employees before check information can be

added.

There are different databases in

each program module for organizational purposes.

For example,

names, addresses, phone numbers in general

databases,

check information in detailed databases and past

information is posted / stored in the permanent databases

( so that current information is not cluttered up by what

you have done in the distant past).

If you are not viewing information

you have entered it may be because it is in a different

database than you are looking for it.

For example, in accounts payable and payroll

you must store detailed check information with X's

or *'s to the check registers before you can print checks.

There is a minimum amount of

information you can enter in to the program, such as,

names and amounts and the program will function.

The drawback to only entering the most important

information and not entering other information, such as,

account numbers, category numbers and dates is that you

may not see all of the information you may like on the

reports if it has not been entered in the input parts of

the program.

Some of the reports are in Elite or

Condensed print.

If you are using the wrong printer driver for your

computer the printer might not switch to elite or

condensed print.

Another solution to this problem is to turn your

printer on condensed or elite print if your printer

supports this.

The reports aged payable, tax

reports, year to date reports) where made elite and

condensed because of the large volume of information

variables they contain.

If you have any trouble with setting up your

printer feel free to call our technical support line.

If you are using job costing the

job number is the last three digits of account number/job

number.

Example 21000.155 . This number could represent an

accounts payable on job number 155.

.24.

Because of the 155 tagged on the

end of the account number this associated information will

be pulled in to job costing providing a job number

00000.155 is created in job costing analysis or

estimating.

When creating a job in EDIT in

JOBCOSTING the program will automatically assign the job

the next available job number, such as 155 so that the

computer can process the number correctly even though only

the last 3 digits of the account number is the job number.

In both accounts receivable and

accounts payable the invoice number is the most important

number because it ties together all payments and partial

payments.

Suppose you are in accounts receivable and you have

invoiced a customer on one invoice for several items they

have bought and they paid you partially upon ordering.

Then at later dates, they send you different checks

for the remainder due on the invoice.

When you Enter Payments in accounts receivable -

Enter Payment information, and have entered the proper

invoice number you are getting paid on, the program will

search through everything that has been paid and invoiced

on that invoice number both in

invoicing and in Enter Payment information and if the

amount received is greater or equal the amount invoiced

all of the invoice items will be marked as paid and this

invoice will no longer show up on unpaid reports.

Similarly, in accounts payable if

you pay several times on an invoice you have received, and

the correct invoice number is entered on the different

checks you are writing, the invoice will be marked as paid

when the amount paid is greater or equal to the amount you

have been invoiced and this invoice will no longer show up

as unpaid on reports.

.25.

Add-Ons

One of the great things about this

program is it may be run on most of the world’s major

operating systems or computer systems. (DOS,UNIX, OS2,

VMS, WINDOWS or MACINTOSH)

In addition, this program has worked with all

network configurations we have yet tried it on.

This program now has bar code

scanning capabilities for an additional $925.00 which

includes scanning hardware, scanning hardware set up and

training.(Great for inventory).

FUTURE ENHANCEMENTS

Additional Specialized Accounts receivable sub modules

such as INTERNAL MEDICINE, LOANS, RESTAURANT, SALES ORDERS

and Fax interface.

Fax

Interface

For further

information contact us at

www.LawSoftware.biz

or

info@LawSoftware.biz

|